FIG PUBLICATION NO. 54

Compulsory Purchase and Compensation

Recommendations for Good Practice

FIG Commission 9 – Valuation and the Management of

Real Estate

Kauko Viitanen

Heidi Falkenbach

Katri Nuuja

Contents

Foreword

Executive summary

1. Introduction

Background

Process of drafting the recommendations

Structure of recommendations

2. FIG Policy Statement on Compulsory Purchase

and Compensation

Recommendations for Good Practice

3. Discussion on the Recommendations for Good

Practice

General principles

Compulsory purchase basis

Proceeding of demarcation and registration

Proceeding for determining compensations

Restitution

References and Bibliography

Orders for printed copies

FIG Commission 9 (Valuation and the Management of Real Estate) took

compulsory purchase and compensations in land acquisition as the main topic for

the period 2007–2010. Compulsory purchase (expropriation, eminent domain) is in

most countries an important tool for acquiring land for the purposes of public

use, even if land acquisition can often be arranged through other means such as

voluntary agreements. Compulsory purchase should ensure that land can be

purchased for adequate development opportunities for the wider public benefit,

while individual land rights and social sustainability are as fully protected as

is possible throughout the process.

FIG Commission 9 was concerned about how well contemporary regulations and

practices function. Because this topic is not covered by valuation standards,

there is a need for guidance from professional bodies such as FIG that can

contribute in gathering and disseminating information and also work as a

discussion forum to support jurisdictions in developing the capacity needed.

Papers on this topic have been presented and discussed at all FIG conferences

held over the four-year term of office and also at a special seminar was

conducted. In addition, three surveys about most the important elements were

undertaken to include FIG member organisations and real estate experts in order

to gather a wide breadth of information.

This FIG policy statement gives recommendations for guidelines in compulsory

purchase and compensation. It lays down the most important factors and makes

recommendations for an equitable, efficient and effective process of acquisition

and awarding of compensation. The publication should be seen as a tool to

support politicians, executive managers, and policy-makers in their efforts to

deal with land acquisition and compulsory purchase in a fair and equitable way,

based on legal standards, full compensation, and acknowledgement of human

rights.

The expert group which prepared the document was led by Professor Kauko

Viitanen, Chair of FIG Commission 9, and included Dr. Heidi Falkenbach, M.Sc.,

LLM Katri Nuuja and Ms. Liping Huang. In addition Commission 9 delegates, and

especially Chair elect Professor Frances Plimmer, and partici-pants and many

experts of real estate property contributed to the document. Also many

organisations outside FIG were actively taking part in preparation: United

Nations Food and Agriculture Organization (FAO), the World Bank, UN-Habitat,

UN-UNEP, Aalto University Real Estate Research Group (REG), and the Government

of Finland particularly the Ministry of Agriculture and Forest (MAF) and

National Land Survey (NLS). MAF, FAO, NLS, and REG have also supported the

project financially.

On the behalf of FIG, we would like to thank the members of the expert group

and all the specialists and organisations who contributed to this publication

for their constructive and helpful work and support.

Prof. Stig Enemark

FIG President |

Prof. Kauko Viitanen

Chair, FIG Commission 9 |

The ownership of real estate property is protected by the constitution in

most countries, as well as by declarations of human rights. Because of the

nature of the real property the right of ownership can, however, be limited.

Thus, society, in various forms of government, has reserved a right to

interfere in personal ownership of real estate, when it is necessary for the

public good. For ex-ample, if the society needs a land area of a real

property for a street, the owner has to convey land for that purpose, if not

voluntary then by compulsion. For this interference there are normally

strict preconditions in order to protect the functions of the free market

and equitable treatment of those whose rights are affected.

This FIG policy statement presents FIG’s recommendations for good practice in

compulsory purchase and compensation in land acquisition and recompense. It aims

to support and inform discussion between valuers, surveyors, real estate

experts, financiers, urban planners, re-searchers, teachers and decision-makers

and develop common principles and the sharing of good practice for shaping the

future of compulsory purchase and compensation in land acquisition and

compensation. It gives support for professional organisations, including in the

area of capacity building and helps to achieve social justice in a resilient

balance between economic development, environmental protection, and the

livelihood of individuals and local communities. FIG believes that these

recommendations are one of tools necessary to help to achieve the UN Millennium

Development Goals.

Singapore. © Stig Enemark

1. Introduction

Compulsory purchase (expropriation, eminent domain) is a vital tool in most

of countries for land acquisition for public purposes, although in many

countries land acquisition can most often be arranged through other means,

especially by voluntary agreements. In some cases the governments can locate the

public activities needed in those places where willingness to sell land exists;

but in other cases it is necessary to take land in specific places to achieve

sustainable and resilient urban or rural structures, i.e. in case of streets or

water protection structures. In recent years, discussion of the

use of compulsory purchase has been rather limited and new legislation,

practices and methods of valuation for compensation may have developed and been

adopted. FIG’s Commission 9 concerns were about how well these new legislations

and practices function and also whether the old methods and procedures might

have become ineffective or unfair and un-popular.

The most critical point concerning compulsory purchase may be the question of

compensation. Will the compensation regulations, valuation methods and manners

really lead to full and just compensation for those adversely affected? The

rules for compensation depend on the legislation of each country. The main

principle in most countries seems to be that the landowner’s financial situation

shall remain the same despite the compulsory purchase. No one should become

poorer because of compulsory purchase but neither should they gain at the

expense of the taxpayer. Only economic values can be compensated but

non-economic losses cannot. There are no strict rules requiring the owner to be

able to purchase a similar property for the level of compensation awarded,

although the statutory basis of compensation (which tends to be based on the

principle of market value) aims to achieve this, and normally this can even be

expected. But if compensation is not adequate to achieve ‘financial

equivalence’, there is a major risk that in some cases such an unjust situation

will result in a landowner losing the means of making a living It seems that

there are also many countries where the rules and / or practices in compulsory

purchase are still weak, the know-how limited, and the award of compensation

inadequate.

The Helsinki seminar provided, a solid starting point for the identification

of good practice, and recommendations based on fundamental and profound

observations were developed based on the presentations and discussions.

Concerning the procedure of compulsory purchase, it can be observed that, from

the perspective of the acquiring authorities, there is a need for a speedy

timeframe, and low cost process both for taking title and possession of the land

and for the fixing and payment of compensation, avoidance of external costs of

procedure, and there should be sufficient resources available in advance to pay

for the compulsory purchase procedure and the resulting compensation. On the

other side, from the perspective of affected occupants, users and owners, there

is the need for involvement, transparency and information, avoidance of

compulsory purchase (generally – it has to be absolutely necessary), a proper

planning and negotiation process and a payment of what is seen to be ‘fair’

compensation. Those issues are also relevant for foreign investors for whose

developments the land is being acquired. Further, the interests of women/men,

landlords/tenants, formal/informal and indigenous and customary have to be

recognised and respected. Resettlement can be an option in certain situations,

and if possible should be combined with rights to return. (Viitanen & Kakulu

2008a, 2008b).

The major goal of this publication is to support and inform discussion

between valuers, surveyors, real estate experts, financiers, urban planners,

researchers, teachers and decision makers and develop common principles for

shaping the future of compulsory purchase and compensation in land acquisition

and compensation. It strives to offer the potential for new and better practices

and in that way, contribute to a better and more sustainable living environment

for everyone in the world.

The recommendations in this publication can be used, for example:

- To identify different legal structures and practices in compulsory

purchase and compensation in different countries and analyse where they vary

from international best practice

- To study if the compensation statutes, valuation methods and their

implementation can actually lead to full and just compensation (as defined)

and to identify possible shortcomings

- To find achievable and effective solutions to solve identified problems,

especially in developing countries, including the introduction of good

practices and those principles that should be taken into consideration and /

or those that should be avoided

- To be used in developing the national legislation and practices.

Process of drafting the recommendations

Compulsory purchase and compensations in land acquisition and takings was the

main subject of FIG Commission 9 (Valuation and Management of the Real Estate),

for the period 2007–2010. The work was organised in the WG 9.1 led by the chair

of the Commission, Professor Kauko Viitanen. The subject was progressed in all

FIG Working Weeks and conferences by presenting papers and at round table

discussions, and in Commission 9 meetings during the four-year work plan. In

addition two special seminars were arranged in Helsinki 2007 and in Beijing

2008, and the subject was further addressed at the Verona seminar organised by

FIG Commission 7 in 2008.

The WG 9.1’s activities made major progress in the seminar on Compulsory

Purchase and Compensation in Land Acquisition and Takings held in Helsinki. The

seminar was organised in conjunction to the Baltic Valuation Conference and in

co-operation with FIG Commissions 7 and 8, FAO’s Land Tenure Service, the World

Bank, the Finnish Association for Real Estate Valuation, the Finnish Association

of Surveyors, the Ministry of Agriculture and Forest in Finland, the Na-tional

Land Survey in Finland, the Nordic Journal of Surveying and Real Estate Research

and the Helsinki University of Technology / Department of Surveying.

The Helsinki seminar was attended by about 120 very active participants from

35 countries with more than 40 very interesting presentations. Of all papers, 21

papers went through the peer-review process and in addition three were reviewed

in the connection of the FAO “Land Reform, Land Settlement and Cooperatives”

journal 2008/1. The presentation slides have been published on the seminar

website. The full papers have been published mainly in the above mentioned FAO

journal themed on “Compulsory Purchase and Compensation”, in the special

edition of the “Nordic Journal of Surveying and Real Estate Research” and

in the seminar book (Viitanen & Kakulu 2008b) published in the research series

of the Department of Surveying at the Helsinki University of Technology.

Based on the discussions in seminars and conferences the first draft of the

recommendations was structured. Thereafter, a questionnaire aimed at testing

whether the recommendations received international acceptance was prepared, and

mailed to participants of the Helsinki seminar, FIG commissions 7, 8, and 9

delegates and some other real estate experts in the summer of 2009. The results

of the survey were then presented and discussed at the FIG regional conference

in Hanoi in October 2009. Based on these discussions, a second draft version was

presented at the FIG Congress in Sydney in April 2010 and, after modification,

sent for comments in June 2010 to the same group as before. The final draft

version was once again sent for comments in September 2010 to those actively

taken part in WG 9.1. The aim in the two feedback rounds was to be sure that all

important areas have been covered in the guidelines and that the recommendations

correspond to a widely-accepted view about principles and good practices. The

FIG policy statement and guidelines were then finalised in October 2010.

Structure of recommendations

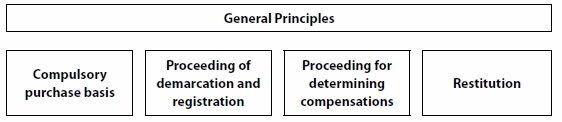

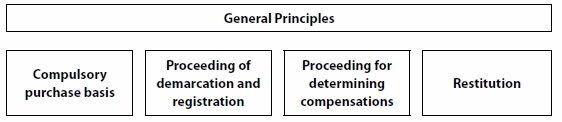

The recommendations are divided in five sections (Figure 1). General

principles give overall guidelines to be followed when structuring regulations

and activities in land acquisition by compulsion, and should be applied in all

phases on the compulsory purchase process. The other four sections discuss in

more detail, recommendations related to the separate phases of compulsory

purchase process, i.e. compulsory purchase basis, proceeding for the demarcation

and registration, the proceedings for the determining compensation, and

restitution.

A more detailed discussion on the recommendations is provided in Section 3 of

this publication. The aim of the discussion section is to help readers to

understand more easily the purpose of each recommendation and to provide

examples. However, the discussion is not exhaustive and should only be taken as

illustrative.

Figure 1: The Structure of recommendations.

2. FIG Policy Statement on Compulsory

Purchase and Compensation

Recommendations for Good Practice

1 Compulsory purchase shall not be the preferred tool for the acquisition of

land.

1.1 Compulsory purchase is not the preferred option if other routes to

land acquisition can be pursued, such as voluntary means, land exchange1

or compulsory purchase of partial rights.

1) Also

referred to as land-for-land exchange.

1.2 There are circumstances where due to scale of project or

complexity of ownership structure, compulsory purchase can, however, be the

only feasible option.

2 The compulsory purchase shall be implemented with respect for the rights of

affected parties.

2.1 Affected parties and the rights to be taken from them shall be

identified in the proceedings.

2.2 Affected land owners, right holders, legitimate occupiers and legitimate

users of the land to be acquired as well as persons and different

organisations and groups that are affected by the compulsory purchase shall

have an opportunity for genuine participation.

2.3 Affected parties, including the poor, women and young people, shall be

able to participate effectively in the process and authorities shall provide

them the necessary opportunities, advice, assistance, capacity building and

knowledge enhancement.

2.4 Affected parties shall have the right to be present, comment, request

and be provided with information on issues affecting them, and have their

views and comments taken into account before decisions are made. A written

statement should explain how such views etc. have been taken into account in

the decision(s) made.

3 The compulsory purchase shall be legitimate.

3.1 All aspects of the complete process, in which land is taken, the

awarding of powers and the process(es) for acquisition shall be clearly and

specifically enshrined in legislation.

3.2 The right to compensation for all losses incurred as a result of the

compulsory purchase or depreciation in value of land rights, the method of

assessing, agreeing, determining (in the case of non-agreement) and paying

compensation to relevant parties shall be clearly and comprehensively laid

down in legislation.

3.3 The process for land acquisition and the payment of compensation shall

be implemented in accordance with the legislation and internationally

recognised best practice.

4 The compulsory purchase process shall be an inherent part of the process of

land acquisition and be exercised in an objective, impartial, independent and

ethical manner.

4.1 The body conducting the compulsory purchase procedure shall be a

body, which is independent and impartial from the other actors

4.2 Ex-officio2 principle or other

processes, which guarantee that incapable persons (including those absent at

the time the acquisition takes place) get a right and fair treatment, shall

be applied.

2) Ex officio

refers here to the principle where the party responsible of the procedure

(e.g. compulsory purchase procedures) is expected to give the affected

parties legal protection even if they have not made a request in that

effect. In the case of compulsory purchase, an example of the application of

this principle requires the body conducting the expropriation procedure to

determine the just compensation as part of the due process of law, without

the affected party having to request it. Thus, compulsory purchase is not

possible without a just compensation to the property right owner who suffers

of the compulsory purchase.

4.3 The persons responsible for conducting the compulsory purchase

shall have the necessary professional and technical competence and

experience as well as adequate resources to undertake the task; the

requirements for competence and experience shall be defined in law.

4.4 There shall be a code of ethics (code of conduct) to serve as a guide to

the highest professional conduct in the process of compulsory purchase and

the assessment of compensation.

5 The compulsory purchase process shall be transparent.

5.1 All documents relevant to the procedure shall be available to

affected parties.

5.2 Affected parties shall have the right and a genuine opportunity to

access the information.

5.3 Information shall be communicated in a manner which affected parties

understand.

6 The costs of the compulsory purchase process are to be carried by the

expropriator.

7 The right to appeal to an independent court shall be ensured.

7.1 Affected parties shall have the right to appeal against separate

decisions of compulsory purchase, e.g. basis of expropriation, cadastral

procedure and compensation.

7.2 Affected parties shall be informed about the appeals procedure(s)

available during the different stages of the process.

8 Affected parties have the right to represent themselves and / or use an

attorney, expert, or agent to do so.

8.1 The reasonable expenses are to be paid by the expropriator.

9 Compulsory purchase can only be used for public interest.

9.1 Compulsory purchase shall only be used if the benefits to the society

exceed the inconvenience and harm caused affected parties who are

disadvantaged by the process of land taking and the subsequent development

(if any).

10 The basis of compulsory purchase shall be legitimate.

10.1 Principal purposes for which land can be taken shall be clearly

identified in legislation.

10.2 The law shall determine who is entitled to use compulsory purchase.

10.3 When the compulsory purchase right is based on a plan (e.g. land use

plan), it shall be defined in law how the right to use compulsory purchase

is initiated and how the process of land designation can be challenged.

11 The scope of compulsory purchase shall be determined so that it causes the

least harm to affected parties while ensuring that the project for which land is

taken can be implemented effectively.

12 When the right to use compulsory purchase takes effect, the time limit for

starting the proceeding shall be set.

12.1 The compulsory purchase should be implemented without delay.

12.2 The time limit for starting the proceeding shall be established in

legislation.

12.3 If this time limit is exceeded, the landowner or the occupants, whose

land is identified within the proposed expropriation, have the right to

claim for the compulsory purchase proceeding, if it is not claimed by the

expropriator.

13 Where the authority intends to acquire only part of an individual’s land,

a formal opportunity shall exist that allows or includes the provision for the

dispossessed party to inquire whether there is to be a partial or total

acquisition of their property.

14 Cadastral procedure related to compulsory purchase and takings shall be

defined by law.

15 Demarcation shall be done according to the compulsory purchase permit.

15.1 The need for a terrain survey shall be evaluated.

16 Relocation of servitudes, easements etc. rights shall be taken care of

within or coordinated in the compulsory purchase process.

17 Boundary and other ownership disputes over legal rights shall be resolved

in connection with the process.

17.1 The expropriator shall be responsible for the costs of resolving

disputes which stem from compulsory purchase.

17.2 The expropriator shall not be responsible for the costs of resolving

disputes which do not stem from compulsory purchase.

18 Registration of the changes in the boundaries of properties and rights

shall be entered into the cadastre and land register, or other relevant register

and records as recognised and accepted by the authorities and affected

communities, on an ex-officio basis, or through other processes. Such processes

should guarantee that also incapable persons are appropriately protected.

19 The compensation shall ensure that the affected party’s financial position

is not weakened. The term just compensation is, therefore, defined as the level

of compensation paid which does not weaken the affected party’s financial

position.

19.1 Legislation shall define which losses are compensated and which

should be tolerated without compensation.

19.2. Legislation should also determine any preconditions for receipt of

compensation e.g. nature of tenure, any occupational requirements.

20 The basis and principle terms of compensation shall be defined by law.

21 The law shall also determine

– who is to be compensated

– the valuation date

– principles of the payment of the compensation

– who will fix the amount of compensation payable

– process by which compensation is fixed, agreed, appealed, paid and the

rate of and extent to which interest may be paid on any outstanding amount.

22 The law shall ensure just compensation (as shown in Recommendation 19) and

ensure that all items of loss which flow naturally and reasonably from the

process and outcome of acquisition and development are compensatable.

Legislation may provide different bases on which different losses may be

determined, subject always to the overriding outcome that the affected party’s

financial position shall not be weakened. Thus legislation may define the base

or the bases which of the following to be assessed in compensation:

– compensation for the object taken

– compensation for compulsorily purchased rights

– compensation for severance and injurious affection to land held with land

taken and to those who are not expropriated but whose land is nevertheless

reduced in value as a result of the acquisition and subsequent development

and its operation

– damages or disturbance (e.g. replacement costs and harm and damage related

to the removal of goods, fixtures, fittings and stock in trade, all losses

related to the dispossession as well as mortgage arrangement costs and

transaction costs)

– compensation for all surveyors and legal costs (also including

compensations for those whose land is not expropriated but merely

depreciated in value).

23 If a residence or a business is compulsorily purchased, the compensation

shall be sufficient for a replacement dwelling or a replacement business

establishment which corresponds to compulsorily purchased property in physical

conditions as well as economic and location attributes.

24 Compensations shall be determined so that the affected party’s financial

status does not suffer a loss because of taxation.

25 If there are losses which are considered unsure or unlikely or cannot be

assessed at the time of the proceedings, there shall be a possibility for

compensation if these losses actualize in the later stage.

26 It shall be clearly stated in law if the impact from the project or the

compulsory purchase is taken into account when assessing the value of the

object.

26.1 It shall be made clear whether or not the gains in the value of land

arising from the project are deducted from the compensation payable

(betterment deduction).

27 In particular in the case where compulsory purchase is for public purpose

undertaken by other than a public body, profit-sharing principles shall be

determined by law.

28 Compensation for the object shall in the first instance be determined

based on market value.

28.1 If market value cannot be determined, the compensation for object

shall be based on fair value.

29 The valuation process and the valuations shall be done according to the

International Valuation Standards (IVS), or other recognised valuation

standards.

30 Inaccuracy of the valuation shall be taken into account when determining

compensation so that the expropriator bears the risk for inaccuracy.

31 Compensation shall be directed to those whose economic status is adversely

affected by the compulsory purchase.

31.1 The parties who are entitled to compensation shall be specifically

identified within legislation and the process of implementing powers of

compulsory purchase.

31.2 Customary rights, family rights, women’s rights, societal forms of

property rights (tribal/group/individual) and informal possession rights

shall be included and recognised within the process of implementing powers

of compulsory purchase, as well as the legislation established for the

payment of compensation.

31.3 The rights of the legitimate mortgage holders shall be secured.

31.4 Compensation shall be deposited according to the legal structures of

the specific country (e.g. escrow account) when the owner is unknown or

ownership is in dispute, the lien is threatened, etc.

32 Compensations shall be paid prior to the taking of possession by the

authority.

32.1 In the case of pre-possession, compensation of the object, or an

advance payment based on the expropriator’s estimated amount of

compensation, shall also be paid prior to the pre-possession.

32.2 If the residence or source of livelihood is compulsorily purchased,

there shall be a reasonable time between the date compensation is paid and

the date of possession (advance payment as in 32.1 above)

32.3 The part of compensation, which is under dispute as at the date of

possession, shall be deposited with the courts and managed in accordance

with national legislation.

32.4 It shall be defined in the law whether the possession is possible if

the compensation has been appealed, especially in the case of a residence or

business.

33 Compensation shall be paid in money.

33.1 If the party who conveys the property agrees, the compensation can

be paid in alternative ways, such as land and corporate shares, or through

proceedings such as land swap.

34 Compensation shall be paid in a single once and for all payment.

34.1 For components other than compensation for object, annual payments

of compensation can be used, if the party who conveys agrees to such regular

payments and legislation enables it.

35 Interest shall be paid on outstanding compensation from the valuation date

or possession date, depending on which is earlier, till the full payment is

made.

36 The payment of compensations shall be made in due time

36.1 The payment of compensation shall be controlled by the body

responsible for the procedure.

36.2 If the compensation is not paid on time, the affected party shall have

the right to force payment through the court process or, assuming that the

authority has not taken possession and commenced development, to require

that the compulsory purchase shall be annulled.

36.3 In such circumstances as are outlined in 36.2, the authority shall be

liable to pay the affected party’s costs as well as higher than usual levels

of interest on the outstanding amount of compensation.

37 If the purpose of compulsory purchase is cancelled, abandoned or rights

are lost through the expiration of a time limit, the obligation for restitution

shall be determined in the law.

37.1 The law shall determine the time period within which the obligation

is in force, according to the national provisions.

37.2 It shall be defined in the law whether the original landowner shall

have the right of first refusal if the compulsorily purchased land is to be

sold in the open market.

37.3 If the property has been legally or physically altered in any way (e.g.

by the award of planning permission or by the construction of some object,

not including the construction of new boundaries, then it shall be specified

in law the time period within which the original owner shall have the right

of first refusal on such land.

37.4 In all cases, an original owner shall pay open market value for the

land, fixed as at the date the property is offered back by the authority.

38 Legislation may provide for other government departments or national

authorities to seek to appropriate the land from the original purchasing

authority for another use.

38.1 Legislation shall specify if and under what conditions land

purchased by one authority for a stated purpose can be appropriated by

another authority for a different purpose.

38.2 Where subsequent authorities have appropriated the land from the

original authority but the land remains unused for a period of time

specified in legislation, then the rights of the original owner, under

Recommendation 37, to purchase the land back from either the original or

subsequent owner authorities shall be recognised.

Vancouver, Canada © FIG

3. Discussion on the Recommendations for

Good Practice

1 Compulsory purchase shall not be the preferred tool for the acquisition

of land.

1.1 Compulsory purchase is not the preferred option if other routes to

land acquisition can be pursued, such as voluntary means, land exchange3

or compulsory purchase of partial rights.

3) Also

referred to as land-for-land exchange.

1.2 There are circumstances where due to scale of project or complexity of

ownership structure, compulsory purchase can, however, be the only feasible

option.

The recommendation outlines the principle for selecting the method for land

acquisition. As compulsory purchase constitutes an infringement to the rights of

the affected party, other, less draconian methods should be used whenever

possible.

These methods include the attempt to acquire the land through voluntary

means, i.e. by agreement for sale with the owner of the property. This should be

seen as the preferred means of acquisition. Other alternative methods include

land exchange, where the land owner is compensated with land of equal or similar

value (not less) in exchange for the land needed for the project. It is also

possible, that the compulsory purchase only concerns partial rights, such as

usufruct, and the land owner retains the ownership to the property. Another

possibility is for the acquiring authority to create and acquire an easement or

servitude for the purpose of the project.

An example of this approach is in the building of a power line, where

usufruct to the area needed for the project is issued to the company realizing

the project and the affected party retains ownership of the property. The

landowner may continue to use the property e.g. for agriculture or forestry,

subject to the right of the company for access onto the land to inspect,

maintain, repair etc. their structures. However, there are projects in which

this approach is not possible, because the project in question requires an

exclusive right of possession to the property.

The scope in which the alternative acquisition methods should be considered

varies depending on the situation and the project. Recommendation 1.2 states,

that in some cases compulsory purchase may be the only feasible option for land

acquisition and development. This may occur in cases, where the scope of the

project is large and/or the ownership of the area concerned is complex (e.g.

there is a high number of absentee owners or ownership is highly fragmented).

Thus finding an alternative method to acquire all needed land may in practice be

impossible.

When considering the method of acquisition, a balance between the fairness,

cost efficiency and effectiveness of the process should be made. Attempting to

obtain agreements with all landowners may be unreasonably time-consuming (and

therefore costly) and risk the success of the project.

Nevertheless, in all circumstances, alternate means of land acquisition (i.e.

the avoidance of compulsion) are the preferred options and should be considered

in every case, as described in Recommendation 1.1. Recommendation 1.2 should be

considered as an exception to the main rule.

2 The compulsory purchase shall be implemented with respect for the rights

of affected parties.

2.1 Affected parties and the rights to be taken from them shall be

identified in the proceedings.

2.2 Affected land owners, right holders, legitimate occupiers and legitimate

users of the land to be acquired as well as persons and different

organisations and groups that are affected by the compulsory purchase shall

have an opportunity for genuine participation.

2.3 Affected parties, including the poor, women and young people, shall be

able to participate effectively in the process and authorities shall provide

them the necessary opportunities, advice, assistance, capacity building and

knowledge enhancement.

2.4 Affected parties shall have the right to be present, comment, request

and be provided with information on issues affecting them, and have their

views and comments taken into account before decisions are made. A written

statement should explain how such views etc. have been taken into account in

the decision(s) made.

The recommendation requires the recognition of the rights, including human

rights, of the affected party in the compulsory purchase process. These include

the right and the opportunity to participate effectively in the process.

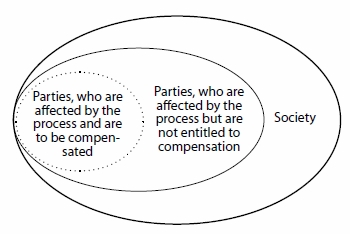

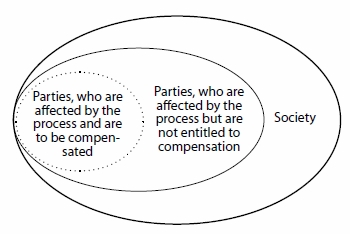

Recommendation 2.1 requires all affected parties and the rights to be taken

from them to be identified in the proceedings (see Figure 2). Identification is

necessary to ensure, that all affected parties are given the opportunity to

participate and receive a fair treatment in the process and that the property

rights taken from them as well as claims for compensation are fully taken into

account in the implementation of the compulsory purchase decision or permit.

Figure 2: Parties in compulsory purchase.

It should be noticed that the borderline between the affected parties entitled

to compensation and affected parties not entitled to compensation may be

different for the different components of the compensation and that not all

effects of the project are compensated as compensation thresholds might be

adapted.

The requirement of identification applies to parties, whose identity is known

or can be reasonably obtained. Attempts should be made to trace and contact

absentee owners. It should be noted that the compensation shall be guaranteed

and assessed for all affected parties who have right to it, even though they

might not have been contacted (see Recommendation 4.2).

Recommendations 2.2 and 2.3 list examples of groups of persons, who should be

considered as affected parties in the process and given the right to participate

and have their views taken into account in the process.

A requirement for effective participation is that sufficient information

about the process is given to all affected parties equally (see Recommendation

5). Participation also means that all affected parties have the right to be

present, represented at, and to be heard in the proceedings, to make statements

as well as requests on issues affecting them before decisions are made. All such

comments, statements, views and requests should be taken into account in the

making of decisions.

3 The compulsory purchase shall be legitimate.

3.1 All aspects of the complete process, in which land is taken, the

awarding of powers and the process(es) for acquisition shall be clearly and

specifically enshrined in legislation.

3.2 The right to compensation for all losses incurred as a result of the

compulsory purchase or depreciation in value of land rights, the method of

assessing, agreeing, determining (in the case of non-agreement) and paying

compensation to relevant parties shall be clearly and comprehensively laid

down in legislation.

3.3 The process for land acquisition and the payment of compensation shall

be implemented in accordance with the legislation and internationally

recognised best practice.

Recommendation 3 outlines the application of the fundamental principle of

legality in both the right to use compulsion to acquire land, in the compulsory

purchase process, and in the determination and payment of compensation.

Considering the nature and the degree of infringement which compulsory

purchase powers causes to the affected party’s rights, the right to take land

using compulsion, the process adopted, the base(s) of expropriation, rules

concerning fixing and payment of compensation as well as all other relevant

issues concerning compulsory purchase and compensation should be clearly and

comprehensively authorized in legislation. It is also imperative that the legal

process is implemented by all practioners. This is also necessary to ensure

equal treatment of affected parties in all cases of compulsory purchase as well

as the comprehension, equity and predictability of the application of the

procedure.

The predictability of the process as well as the ability to ensure the

implementation of projects that meet the agreed requirements is also important

from the point of view of the expropriator as well as society in general.

4 The compulsory purchase process shall be an inherent part of the process

of land acquisition and be exercised in an objective, impartial, independent and

ethical manner.

4.1 The body conducting the compulsory purchase procedure shall be a

body, which is independent and impartial from the other actors

4.2 Ex-officio4 principle or other

processes, which guarantee that incapable persons (including those absent at

the time the acquisition takes place) get a right and fair treatment, shall

be applied.

4)

Ex officio refers here to the principle where the party

responsible of the procedure (e.g. compulsory purchase procedures) is

expected to give the affected parties legal protection even if they have not

made a request in that effect. In the case of compulsory purchase, an

example of the application of this principle requires the body conducting

the expropriation procedure to determine the just compensation as part of

the due process of law, without the affected party having to request it.

Thus, compulsory purchase is not possible without a just compensation to the

property right owner who suffers of the compulsory purchase.

4.3 The persons responsible for conducting the compulsory purchase shall

have the necessary professional and technical competence and experience as

well as adequate resources to undertake the task; the requirements for

competence and experience shall be defined in law.

4.4 There shall be a code of ethics (code of conduct) to serve as a guide to

the highest professional conduct in the process of compulsory purchase and

the assessment of compensation.

This recommendation lays out general requirements concerning the impartiality

and independency of the compulsory purchase process as well as qualification

requirements and ethical guidelines to the body conducting the process.

Firstly, the body conducting the compulsory purchase procedure should be an

independent and impartial body, i.e. it should have no affiliation to either the

expropriator or any of the affected parties that may cause doubt of the

impartiality of the body. The body conducting the compulsory purchase process

should work exclusively within the legislation and internationally-recognized

best practice. Such an organisation should be subject to public scrutiny and to

wider democratic and professional accountability for its performance.

Recommendation 4.1 applies to both the decision making body, as well as the body

implementing the compulsory purchase.

Recommendation 4.2 concerns the responsibility of the body conducting the

compulsory purchase in ensuring that all affected parties’ rights are thoroughly

respected and duly taken into account in the process, in accordance with the

legislation and internationally recognized best practice. For example, those who

are incapable or who are absent at the time acquisition takes place are treated

in the same way as if they were fully represented, and compensation determined

accordingly (see footnote on the ex officio principle)

Recommendations 4.3 and 4.4 lay down requirements as to the qualification and

professional ethical guidelines of the body and/or the individuals conducting

the compulsory purchase process. Firstly, the persons responsible for carrying

out the compulsory purchase process and making the necessary decisions in it

should have the competence needed (e.g. requirement of a certain level and

quality of education as well as technical and professional expertise in specific

fields such as land management, real estate valuation, real estate law) as well

as previous experience and competence in conducting such processes. The

application of this recommendation varies due to differences in national

education systems, but it serves as a guideline in evaluating the national

professional requirements.

Secondly, a code of ethics should act as a guide to the highest professional

standards of conducting the compulsory purchase procedure and the assessment of

compensation. Many national and international organisations in the field have

issued such codes, which apply to the member associations and members of such

bodies (e.g. Council of European Geodetic Surveyors [CLGE], Code of Conduct for

European Surveyors, signed 11–12 September 2009). It is vitally important that

the professional and technical expertise involved in this work is enhanced by

the highest code of ethical behavior, given the economic, social and political

importance of land rights issues, as well as the often large amounts of

compensation involved. Adherence to the highest ethical standards should

encourage public trust and confidence in the processes involved, and should thus

facilitate a less adversarial, protracted and costly process.

5 The compulsory purchase process shall be transparent.

5.1 All documents relevant to the procedure shall be available to

affected parties.

5.2 Affected parties shall have the right and a genuine opportunity to

access the information.

5.3 Information shall be communicated in a manner which affected parties

understand.

The recommendation outlines the requirement that the compulsory purchase

process be transparent. This recommendation has a strong link to Recommendation

2, which emphasizes the genuine participation of the affected parties in the

process. Transparency and sufficient provision of information about the process

is essential to ensure effective participation.

Recommendations 5.1 and 5.2 lay out, that all documents relevant to the

process should be made available to the affected parties and that they must have

the right and the opportunity to access the information. Absentee owners must be

taken into account and reasonable measures taken to identify and inform them.

Relevant information should be given as early in the different stages of the

process as possible. It is especially essential, that all affected parties

receive information about the initiation of the process.

The information given should also be in a form that can be understood by all

the affected parties (Recommendation 5.3). Thus, the authorities should not only

ensure that the technical and legal language is translated into easy to

understand language, but also that there are opportunities for those involved to

have both the process and their rights explained to them, in good time, so that

they are able to make informed choices, comments and arguments. This

recommendation is emphasized in areas where several languages are used, means of

local communication are fragmented or the illiteracy rate is significant.

The forms of giving information could normally include publication in local

newspapers, as well as letters addressed to those individual land occupiers and

owners, and, where such individuals cannot be found, notices fixed to the land

itself. Consideration should also be given to setting up mobile centres of

information so that individuals can more conveniently access both written and

oral information, where appropriate.

6 The costs of the compulsory purchase process are to be carried by the

expropriator.

Recommendation 6 requires that the costs of the compulsory purchase process

are to be carried by the expropriator. Affected parties are involuntarily

participating in the process and should thus not be responsible for any costs

that incur directly from carrying out the proceedings. These include e. g. the

costs of the administrative process as well as registration.

Recommendation 8 concerns the costs from representation and the use of

experts. Thus, these costs are not discussed under Recommendation 6.

Recommendation 6 refers to costs that are incurred from the process of

expropriation. Howeverr, on any costs incurred from appeals, legislation

concerning the responsibility and division of the costs applies (this could be

general legislation concerning the court proceedings or special legislation

concerning the court proceedings in compulsory purchase cases).

7 The right to appeal to an independent court shall be ensured.

7.1 Affected parties shall have the right to appeal against separate

decisions of compulsory purchase, e.g. basis of expropriation, cadastral

procedure and compensation.

7.2 Affected parties shall be informed about the appeals procedure(s)

available during the different stages of the process.

Recommendation 7 concerns access to justice and the affected parties’ right

to appeal decisions made in the compulsory purchase process and the assessment

of compensation to an independent court to ensure their legal protection and

that the acquisition process is undertaken in accordance with the legislative

provisions. This right should extend to all relevant elements of the process,

which include the legal right to take the specified land for the stated

purpose(s), the use of compulsion, the non-availability of any alternative means

of acquisition (see Recommendation 1 above), the base of expropriation in

carrying out the project in question, the cadastral process needed for

compulsory purchase as well as issues concerning compensation.

Thus, at some point in the process, there must be a right to object to:

a. the taking of the actual land

b. the use of compulsion

c. the purpose(s) for which the land is to be used

d. the level of compensation to be paid.

It is not necessary (nor is it advisable) that such rights of objection occur

at the same time in the process.

A process should also be available to those adversely affected by the

compulsory purchase to seek an explanation, advice etc. from the body conducting

the compulsory purchase in advance of any recourse to the courts and in

accordance with Recommendation 5 above. Such an approach to these authorities

shall not constitute an appeal, although such a right may be enshrined in

legislation. This is important to ensure that any potential court action is

taken in the clear understanding of both the specific situation and the rights

involved. It should also ensure that court time is not wasted through

misunderstandings, or where agreement can be reached in advance of expensive and

time-consuming legal action.

The appeals procedure is depending upon the national legal and court system

in the country in question. In some countries, there are special land courts

dealing with compulsory purchase cases, where in some countries, these cases may

be heard in general lower courts.

Recommendation 7.2 lays out, that the affected parties should be informed

about the possibility of appeal during the process, e.g. the decisions which may

be appealed and the basis of appeal, the court or other body that has

jurisdiction over the matter as well as the appeal period. Such notifications

must be made so that those affected have sufficient time to avail themselves of

such opportunities.

It may be therefore, that different courts are involved in this process; the

court for appealing against the level of compensation awarded may be different

from that which deals with procedural irregularities, for example. A right of

appeal against the court decision must also be made available, although

limitations may be imposed e.g. appeal within a limited time frame, on a point

of law.

8 Affected parties have the right to represent themselves and / or use an

attorney, expert, or agent to do so.

8.1 The reasonable expenses are to be paid by the expropriator.

Recommendation 8 concerns the representation of the affected parties, as well

as the costs incurred from representation. In order to ensure effective

participation in the compulsory purchase process, as outlined in Recommendation

2 and 6, the affected parties should have the opportunity to have expert

representation and assistance in the process (e.g. an attorney, surveyor expert

or agent).

Since the affected parties are involuntarily involved in the compulsory

purchase process and cannot be expected to have equal knowledge and expertise to

represent themselves in the process, costs of such necessary representation and

assistance should be paid by the expropriator (refer Recommendation 6).

The obligation of the expropriator to pay such costs should be limited to

reasonable costs incurred for necessary expert representation and assistance to

ensure effective participation, and should be paid regardless of any entitlement

to compensation. However, a reasonable fee is not restricted to the lowest cost

basis and the affected party should be able to decide the necessary level of

expertise in order to be duly represented and achieve a fair outcome from the

process. The use of averages to assess costs and items of disturbance should be

only be a consideration and not a benchmark for deciding costs. Each case should

be assessed on its own merits. Any costs in excess of these reasonable costs are

to be paid by the affected party (refer Recommendation 6). National legislation

should include provisions on payment of representation costs.

Where it is necessary for an individual to employ expert representation in

advance of the implementation of the compulsory acquisition process in order,

for example, to protect legal rights or to ensure effective representation at a

relevant hearing or inquiry, expropriators may not be required to pay such

professional fees. Legislation should specify a point at which the expropriator

becomes liable for the costs incurred by those affected by compulsory purchase.

Such a date may be the date when the project is approved, or when compulsory

acquisition powers are awarded to the expropriator. Consideration may be given

by the expropriator in paying costs incurred in advance of this date in order to

ensure efficiency, equity and ethical outcomes in the process, as well as to

relief hardship.

9 Compulsory purchase can only be used for public interest.

9.1 Compulsory purchase shall only be used if the benefits to the

society exceed the inconvenience and harm caused affected parties who are

disadvantaged by the process of land taking and the subsequent development

(if any).

Recommendation 9.1 states that compulsory purchase can only be used for

public interest purposes. Public interest can be defined as an outcome (e.g.

development) in which the public as a whole has a stake and from which the

public as a whole will derive considerable benefit. It refers to actions of a

government or an organ or agent of government which provides services or

development which is recognised in legislation as being of benefit to the

community as a whole. In national legislation public interest may be defined by

or can include such terms such as public use, public purpose or benefit to

society. Unless there is a specific definition in legislation of the term,

public interest is defined by evaluating such things as the nature of the

project for which compulsory purchase is used, its intended outcomes, and the

source of the costs involved in realizing the project. It is not necessary, that

a public body carries out the project, if the project is to serve a public

interest (e.g. construction of a major power line carried out by a private

company).

Using compulsory purchase as the means for land acquisition should be based

on a weighing of interests. The benefit to public good may outweigh the losses

and infringement caused to the private parties affected, but this may not

necessarily be so, if for example the benefits are relatively few and the number

of people adversely affected is relatively large. Costs of acquisition,

development and compensation, however, may not be a reasonably measure to

determine the weighting of interests. Recommendation 9.1 supports the principle

of weighing of interests.

10 The basis of compulsory purchase shall be legitimate.

10.1 Principal purposes for which land can be taken shall be clearly

identified in legislation.

10.2 The law shall determine who is entitled to use compulsory purchase.

10.3 When the compulsory purchase right is based on a plan (e.g. land use

plan), it shall be defined in law how the right to use compulsory purchase

is initiated and how the process of land designation can be challenged.

Recommendation 10 requires the legality of the uses of land for which

compulsory purchase may be used. In addition to the general requirement of

public interest described in Recommendation 9, legislation should identify

clearly the principal purposes for which compulsory purchase is permitted or a

mechanism for establishing such purposes as being of “public interest” as well

as the bodies who are entitled to use it. Detailed lists of projects or plans

are not required, but clear definitions of the above mentioned are vital.

If such uses are established in primary legislation, (i.e. are permanently

available to relevant authorities), then some additional process which

authorizes the taking of (a) particular parcel(s) of land for specific purposes

shall also be required. Such a process must allow for objections and appeals

against both the taking of the particular parcel(s) of land and the use of

compulsion.

In cases where the compulsory purchase right is based on a plan, the

purpose(s) for which property is to be taken must be shown in the plan decision

(e.g. road plan) initiated and authorized by a planning authority, and created

using a process of public consultation and objection and appeal in the creation

of such a plan.

11 The scope of compulsory purchase shall be determined so that it causes

the least harm to affected parties while ensuring that the project for which

land is taken can be implemented effectively.

Recommendation 11 lays out the requirement for minimizing harm caused to the

affected parties while ensuring that the project, for which compulsory purchase

is used, may be implemented. The extent to which compulsory purchase is used as

well as the harm caused to the affected parties and the wider community should

be kept to a minimum. Harm here refers not only to economic losses, but also

other types of harm (e.g. social). The objective should not be minimizing the

award of compensation.

This recommendation reflects a similar principle to that laid out in

Recommendation 1, where other methods of land acquisition are defined as primary

in relation to compulsory purchase. This also reflects Recommendation 2 that the

compulsory purchase is implemented with respect for the rights, including human

rights, of the affected parties. Similarly, when compulsory purchase is

necessary for carrying out the project, the most appropriate and least damaging

approach from the perspective of the affected parties should be used in order to

limit the infringement to their property rights as well as other types of harm.

However, the requirement is not to minimize the harm caused at any cost, but to

choose the least damaging of the economically and practically feasible options

for the implementation of the project.

12 When the right to use compulsory purchase takes effect, the time limit

for starting the proceeding shall be set.

12.1 The compulsory purchase should be implemented without delay.

12.2 The time limit for starting the proceeding shall be established in

legislation.

12.3 If this time limit is exceeded, the landowner or the occupants, whose

land is identified within the proposed expropriation, have the right to

claim for the compulsory purchase proceeding, if it is not claimed by the

expropriator.

Recommendation 12 sets a requirement for the implementation of the compulsory

purchase process. It should be carried out within a reasonable time to limit the

harm caused by the process itself to the affected parties’ interest in the

property. In U.K., for example, the time frame is set to three years.

This recommendation aims to ensure, that the affected parties may require the

initiation of the compulsory purchase process within reasonable time. The

existence of the right or even potential to use compulsory purchase powers

affects the value as well as the opportunities to deal with and use the property

(e.g. marketability might decrease, investment may not be beneficial) in

question. The affected parties should have the right to obtain a decision, in

the expense of the expropriator, about the outcome of the process within a

reasonable time from initiation to minimize their losses caused by the prospect

of acquisition. However, the request should not normally be made prior to the

authorization, by the appropriate authority, of the right, which enables the

authority to use compulsory purchase powers to acquire the particular parcel of

land. Application should be made to a designated court which has the power to

either require the expropriator to proceed with the acquisition or to require

the expropriator to declare that the right of compulsory acquisition for the

land has been abandoned.

In situations where land is identified for use for a public purpose (e.g.

with a development plan) and to which it can only be put by a public authority,

normally using their powers to acquire land, either by agreement or using their

legislative powers, then an owner may find it impossible to dispose of or use

the land for any other purpose. If the prospect of the public use of the land

(and therefore its acquisition) is likely to take place some years into the

future, this may cause hardship for a landowner, who may need to dispose of the

land in order in the meantime. Given that it is most unlikely that anyone would

pay a market value for a property which has been identified for public purposes

within a reasonable period of time, a process should be established whereby an

owner can require that authority to purchase the land for what would otherwise

be market value (i.e. market value in the absence of the threat of public

acquisition and development). If an authority can demonstrate a good reason why

such a process should not be implemented (e.g. the authority has no intention of

acquiring the land in question) then such a process by the landowner can be

defeated.

For example, in Denmark, the land owner may require for the purchase of the

property after the right to use compulsory purchase has been established for

that parcel of land, but before the time limit set for the implementation has

expired. The requirement is, that there are special grounds for this related to

the personal situation of the land owner.

13 Where the authority intends to acquire only part of an individual’s

land, a formal opportunity shall exist that allows or includes the provision for

the dispossessed party to inquire whether there is to be a partial or total

acquisition of their property.

Recommendation 13 sets out the provision that that where an authority

proposes to acquire part only of an individual’s holding of land, affected or

dispossessed party has the right to inquire that all of their property is to be

acquired. Such a decision should be made based on the benefits available to the

landowner of using the retained land, specifically on the loss of amenity or

material detriment caused to the land retained, under all circumstances. If the

use of the retained land is in practice impossible, the authority should have

the obligation to acquire all of the property.

14 Cadastral procedure related to compulsory purchase and takings shall be

defined by law.

Recommendation 14 lays out the requirement to define in legislation the

cadastral procedure and takings. The implementation of the decision enabling

compulsory purchase should be clearly defined in legislation. This includes e.g.

the body conducting the procedure, as well as method and process rules to be

followed.

15 Demarcation shall be done according to the compulsory purchase permit.

15.1 The need for a terrain survey shall be evaluated.

Recommendation 15 lays out the requirement to follow the compulsory purchase

permit in the demarcation. In practice, minor exceptions to the permit may be

necessary and it should be defined in the permit, what scope for such exceptions

the body conducting the cadastral procedure has.

Recommendation 15.1 lays out, that the need for terrain survey shall be

evaluated. This is necessary to ensure the proper implementation of the

compulsory purchase permit. A terrain survey may be unnecessary e.g. in a case,

where a survey has been conducted in connection in a previous process, such as

with drafting a plan.

An authority should have the right, established in legislation, to enter on

to land in advance of acquiring legal rights in order to establish that the land

is suitable for the proposed development, and therefore to be satisfied that

acquisition is necessary. Landowners should allow authorities access on to land

for such purposes, and authorities should be responsible for making good any

damage done to the land and/or buildings, and particularly boundary fences etc.

in carrying out such activities.

16 Relocation of servitudes, easements etc. rights shall be taken care of

within or co-ordinated in the compulsory purchase process.

Recommendation 16 requires other cadastral processes necessary in connection

with the compulsory purchase process to be carried out as an intrinsic part of

the process. These may include relocation of servitudes, easements or other

types of rights.

17 Boundary and other ownership disputes over legal rights shall be

resolved in connection with the process.

17.1 The expropriator shall be responsible for the costs of resolving

disputes which stem from compulsory purchase.

17.2 The expropriator shall not be responsible for the costs of resolving

disputes which do not stem from compulsory purchase.

Recommendation 17 concerns boundary or other ownership disputes, which may

arise between the affected parties in the compulsory purchase process. These

disputes should be solved in co-ordination with the main process, to ensure that

in the process, affected parties and their rights are clearly identified and an

equitable solution agreed. However, the cost for resolving disputes which

clearly do not arise from the compulsory purchase procedure should not be borne

by the expropriator.

Where expropriation involves the removal of or damage to boundary fences,

hedges and other physical boundaries, their reinstatement in an appropriate

location or their repair shall be the responsibility of the expropriator.

18 Registration of the changes in the boundaries of properties and rights

shall be entered into the cadastre and land register, or other relevant register

and records as recognised and accepted by the authorities and affected

communities, on an ex-officio basis, or through other processes. Such processes

should guarantee that also incapable persons are appropriately protected.

Recommendation 18 concerns the registration of the changes resulting from the

compulsory purchase proceedings. The registration should be made in the cadastre

and land register, or other relevant register, as defined by national

legislation and the decisions of the authorities. The recommendation emphasizes

the responsibility of the authorities to ensure that the registration is done

comprehensively and that the right of absent owners and incapable persons are

protected.

Proceeding for determining compensations

19 The compensation shall ensure that the affected party’s financial

position is not weakened. The term just compensation is, therefore, defined as

the level of compensation paid which does not weaken the affected party’s

financial position.

19.1 Legislation shall define which losses are compensated and which

should be tolerated without compensation.

19.2. Legislation should also determine any preconditions for receipt of

compensation e.g. nature of tenure, any occupational requirements.

Recommendation 19 refers to the end result of the compulsory purchase process

and the payment of compensation. It requires that the affected party is paid

compensation in order to ensure that their financial position is not weakened by

the compulsory purchase process. This means that the primary focus in

determining the basis and amount of compensation is in the financial status of

the affected party both in advance of the compulsory purchase process and after.

Recommendation 19.1 concerns the definition of losses, which are not

compensated (so called compensation threshold). Compensation may be granted only

if the amount of depreciation in property value exceeds a minimum financial

threshold. This allows for a de minimis level below which compensation is not

payable, and is based on a principle of a social obligation, where certain

affected parties may be required to tolerate some restrictions without

compensation.

In practice this means defining in legislation the descriptions of

non-compensatable losses for each base of compensation and consideration

regarding the level of harm or nuisance, which should be tolerated without

compensation. For example, a project may cause an increase in the level of

noise, which however can still be considered normal for the particular

environment (e.g. city) and does not cause a significant harmful effect on the

value of the property of the affected party. If compensation thresholds are

applied, the overall status of the affected party should however be considered

(e. g. in cases where several thresholds apply) in order to prevent an

unreasonable outcome for the affected party.

20 The basis and principle terms of compensation shall be defined by law.

Recommendation 20 lays out the requirement to define in legislation the basis

and principles of compensation. This is necessary to ensure the legal protection

of the affected parties as well as the predictability and transparency of the

compensation procedure and assessment.

The basis and principles of compensation should seek to ensure that the

parties’ financial position is not weakened and such a principle should be

recognised in the legislation as the overriding outcome to be achieved,

regardless of the details specified in the legislation.

21 The law shall also determine

– who is to be compensated

– the valuation date

– principles of the payment of the compensation

– who will fix the amount of compensation payable

– process by which compensation is fixed, agreed, appealed, paid and the rate of

and extent to which interest may be paid on any outstanding amount.

Recommendation 21 lays out some specific requirements concerning provisions

to be made within on compulsory purchase legislation. The law should define, who

constitute the affected parties entitled to compensation, the valuation date

(the point in time, according to which compensation is assessed) as well as

procedural issues concerning the payment.

22 The law shall ensure just compensation (as shown in Recommendation 19

above) and ensure that all items of loss which flow naturally and reasonably

from the process and outcome of acquisition and development are compensatable.

Legislation may provide different bases on which different losses may be

determined, subject always to the overriding outcome that the affected party’s

financial position shall not be weakened. Thus legislation may define the base

or the bases which of the following to be assessed in compensation:

– compensation for the object taken

– compensation for compulsorily purchased rights

– compensation for severance and injurious affection to land held with land

taken and to those who are not expropriated but whose land is nevertheless

reduced in value as a result of the acquisition and subsequent development and

its operation

– damages or disturbance (e.g. replacement costs and harm and damage related to

the removal of goods, fixtures, fittings and stock in trade, all losses related

to the dispossession, as well as mortgage arrangement costs and transaction

costs)

– compensation for all surveyors and legal costs (also including compensations

for those whose land is not expropriated but merely depreciated in value).

Recommendation 22 requires that the legislation to ensure that just

compensation as shown in Recommendation 19 above is paid. Just compensation is

based on a definition of losses to be compensated and losses which should be

tolerated (see Recommendation 19.1). This definition should be stated clearly

within legislation.

As Recommendation 22 lays out, legislation should define, which kind of

losses or injury the compensation will cover in the compulsory purchase process,

as well as the base(s) on which different losses may be determined. These may

vary in national legislation. In any event, legislation should ensure that the

overall effect of the legal provisions is that the affected party’s financial

position is not weakened.

In certain cases, it may be financially advantageous for the expropriator to

undertake additional works for the benefit of a landowner, in order to reduce

the level of compensation payable. Such work may e.g. include the construction

of a bridge or an underpass which links two parcels for land which are being

divided by the proposed acquisition and development. In such circumstances, and

with the agreement of the landowner, an expropriator may undertake such works

and compensation payable shall be reduced accordingly to the value of the land

with the benefit of such works.

23 If a residence or a business is compulsorily purchased, the

compensation shall be sufficient for a replacement dwelling or a replacement

business establishment which corresponds to compulsorily purchased property in

physical conditions as well as economic and location attributes.

The requirement for just compensation for affected parties is laid out in

Recommendation 23 (see also Recommendation 22 concerning requirements for

legislation). Special emphasis is put on situations where the object of

compulsory purchase is the residence or business premises of the affected party.

In these cases, the compensation should be sufficient for the purchase of a

replacement dwelling or a business establishment corresponding in all material

respects to the one compulsorily purchased. In identifying the replacing

property, characteristics such as location, physical attributes and, in the case

of commercial premises, future profitability should be taken into consideration.

This Recommendation aims to maintain the standard of living and the source of

livelihood for the affected party. This is especially important in areas, where

price levels fluctuate strongly, as well as in situations, where a direct

replacement is not possible (there are no substitutes in the market).

24 Compensations shall be determined so that the affected party’s

financial status does not suffer a loss because of taxation.

Recommendation 24 states that the effect of taxation on the affected party’s

compensation payment should be taken into account, when determining the effect

of the compulsory purchase on their financial status. The application of this